malaysia rental income tax deductible expenses

The government has issued Decree 522021 on extension of deadlines for tax and land rental payments in 2021. Costs for legal advice and documents that relate to rental activities are tax-deductible.

5 Things To Consider When Filing Taxes On Rental Income Free Malaysia Today Fmt

Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation.

. 6 to 30 characters long. Example Company A entered into a lease agreement to rent an office space for 2 years with a monthly rental of 5000 for 2019 and 2020. Actual results will vary based on your tax situation.

Expenses paid by tenant occur if your tenant pays any of your expenses. ASCII characters only characters found on a standard US keyboard. 5 A 12 Value Added Tax VAT is imposed on residential property leases that satisfy certain conditions.

Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehiclesIts primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Rental Income Deductible Expenses. I have closed my tax file in Malaysia when I relocated to Thailand.

This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom. Section 4 d of the Tax Income Act of 1967 applies to rental income. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

And while advisors and clients have had a few years. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e. My support is about THB.

A foreign rental worksheet can now be created in the 2021 individual tax return ITR. 1 With effect from 1 May 2018 the income derived by a non-individual eg. Stay in Malaysia less than 182 days are taxed at flat rate of 28 without.

You can enter details for the foreign rental including address income expenses and foreign tax paid. Rental Income Deductible Expenses. The VAT burden is generally shouldered by the tenants.

To make sure youre claiming the right costs and paying the right amount of tax each year you should always first talk to your tax accountant or financial advisor. An entity which provides insurance is known as an insurer insurance company. Income tax PCB calculation.

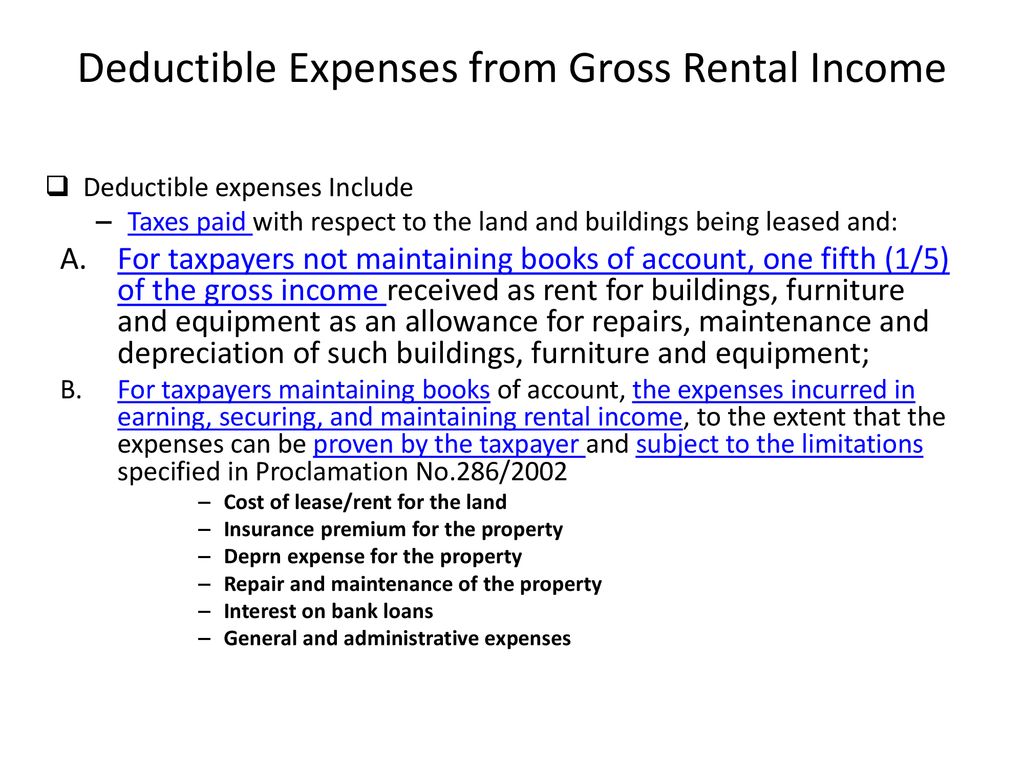

The Income Tax Client report is now available. The letting of real property is also treated as a non-business source if the owner rents out a property where the tenant enjoys maintenance services or support services that are passively derived not actively provided by the property owner. Its important to remember that the way tax deductions relate to property purchases depends on the type value and purpose of the property.

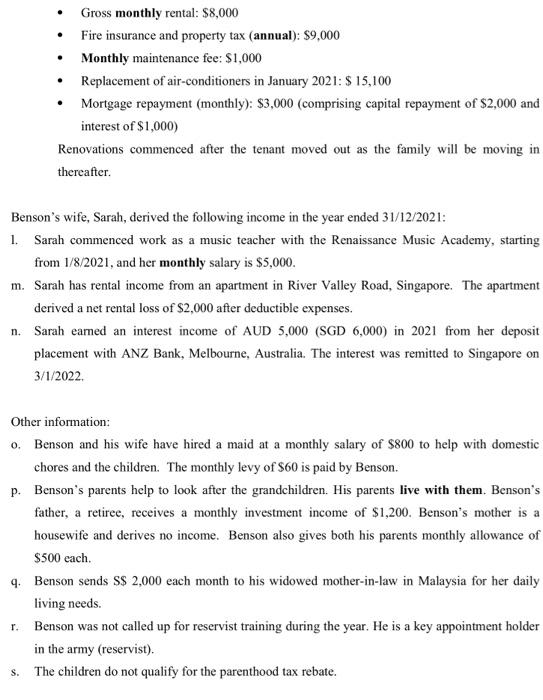

Pays for itself TurboTax Self-Employed. Agent fees including advertising costs. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30.

My monthly PCB income tax is increased much since march 2009 HR told me that Malaysia monthly income tax PCB deduction rate is changed since year 2009. When the net income and tax have been determined any tax withheld in excess of the tax on the net income will be refunded. Stay in Malaysia less than 182 days are taxed at flat rate of 28 without.

The standard corporate income tax CIT rate is 20. The expenses that are income tax deductible including. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss.

The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis. For tax years beginning after 31 December 2025 the percentage of modified taxable income that is compared against the regular tax liability increases to 125 135 for certain banks and securities dealers and allows all credits to be applied in determining the US corporations regular tax liability. Company tax resident in Australia from the provision of services in Singapore through employees or other personnel engaged by the non-individual.

Ps please give me contact details of a. Properties with rental payments exceeding PHP12800 US272 per month received by landlords whose gross annual rental income exceed PHP1919500 US40840 are subject to 12 VAT. However according to the Inland Revenue Department of Hong Kong the following expenses are not tax deductible.

Getting tax advice about property. You can deduct the expenses if they are deductible rental expenses. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

Vehicle insurance may additionally. You must include them in your rental income. Then I would pay tax on my irish rental income and because i will be resident in thailand my state oap would go under the radar.

This report provides details of your linked clients from the ATO. Find your PCB amount in this Income tax PCB 2009 Chart. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

Insurance is a means of protection from financial loss in which in exchange for a fee a party agrees to guarantee another party compensation in the event of a certain loss damage or injury. Expenses you can immediately claim on a rental property 1. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020.

For income tax purposes your company should claim tax deductions based on contractual rental payments regardless of how such expenses are recognised in its accounts. The SME company means company incorporated in Malaysia with a paid up capital of. The expenses that are income tax deductible including.

Increases the amount of income tax you pay. Expenses that were not incurred in the production of profits. The Tax Cuts and Jobs Act of 2017 commonly referred to as TCJA eliminated the deductibility of financial advisor fees from 2018 through 2025.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. Must contain at least 4 different symbols. Whether domestic or foreign sourced and deductible expenses see the Deductions section plus other assessable income.

Calculate your taxable salary Taxable Salary Gross Salary EPF. 50 not more than 100000 THB. In general expenses incurred for the production of business income are tax deductible.

For example your tenant pays the water and sewage bill for your rental property and deducts it from the normal rent payment. However if you held onto the property for more than a year before selling it youre eligible for a.

Types Of Taxes In Malaysia For Companies

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Htj Tax

Benefits Of Owner Occupied Rental Property Duplex Triplex Four Plex

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide

Form 1116 Foreign Tax Credit Here S What You Need To Know Htj Tax

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

:max_bytes(150000):strip_icc()/TaxableIncome_Version1_4188122-635a1cf2f69a48f5bdcc697eb075b5a4.png)

Taxable Income What It Is What Counts And How To Calculate

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

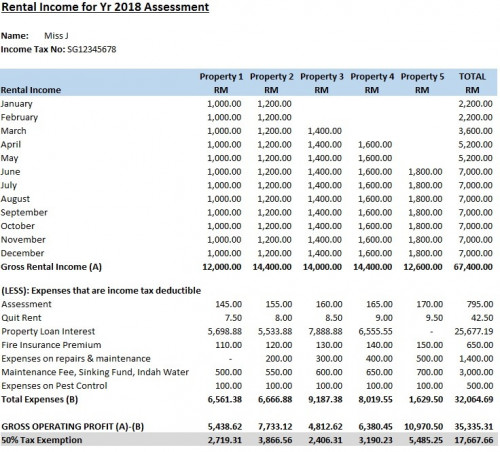

How To Calculate My Rental Income Hardwarezone Forums

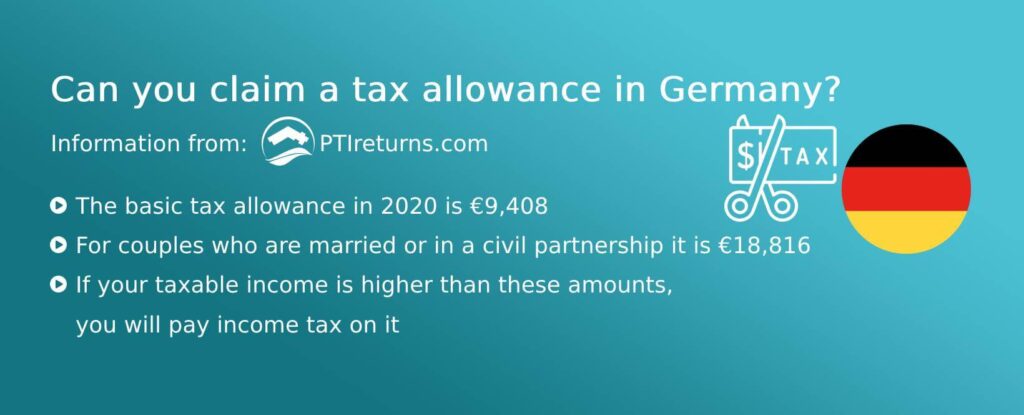

German Rental Income Tax How Much Property Tax Do I Have To Pay

Multiple Properties Rent Income Excel Template 15 Rental Etsy

Must You Declare Your Rental Income To Lhdn Landlord Tax Incentives Iproperty Com My

50 Tax Exemption For Rental Income 2018 2020

Are Property Management Fees Tax Deductible And Other Tax Questions Answered

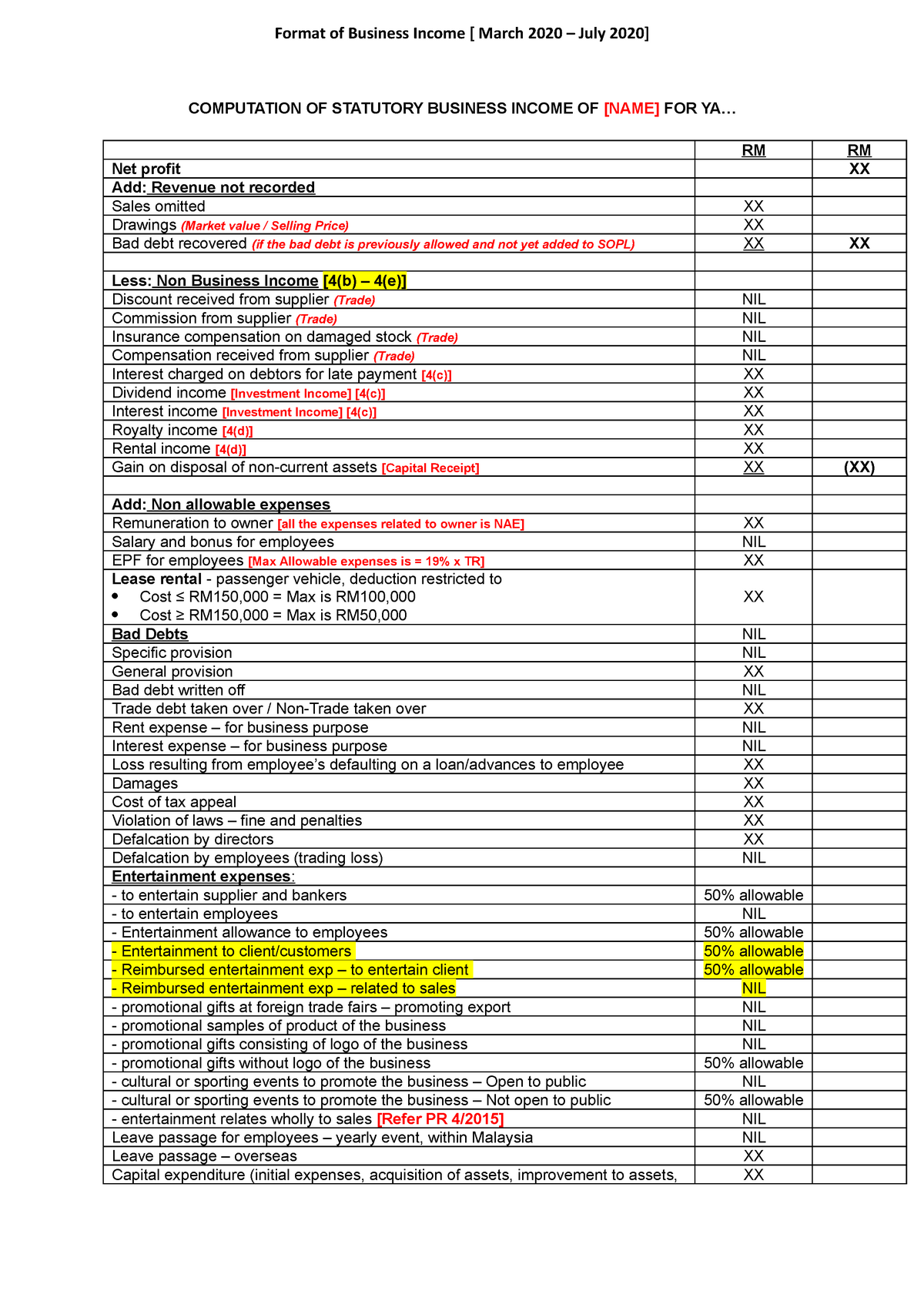

Business Income Format Of Business Income March 2020 July 2020 Computation Of Statutory Studocu

Rental Income Tax Accounting Ppt Download

8 Things To Know When Declaring Rental Income To Lhdn

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Solved All Amounts Provided In The Information Are In Chegg Com

Comments

Post a Comment